2025 Snowboard Pre-Orders

-

Yes. Basic Snowboard - 2025Regular price From $699.99

-

Ride Warpig Snowboard - 2025Regular price $949

-

Salomon Huck Knife Snowboard - 2025Regular price $839.99

-

Pre OrderCapita Defenders Of Awesome Snowboard - 2025148 150 152 154 156 +1 More148 150 152 154 156 +1 MoreCapita Defenders Of Awesome Snowboard - 2025Regular price $949.99

Pre OrderCapita Defenders Of Awesome Snowboard - 2025148 150 152 154 156 +1 More148 150 152 154 156 +1 MoreCapita Defenders Of Awesome Snowboard - 2025Regular price $949.99 -

Ride Psychocandy Snowboard - 2025Regular price $949

-

Yes. Basic Women's Snowboard - 2025Regular price $759.99

-

Salomon Assassin Snowboard - 2025Regular price $899.99

-

Salomon Dancehaul Snowboard - 2025Regular price $849.99

-

Capita Mercury Snowboard - 2025Regular price $1,149.99

-

Capita Paradise Snowboard - 2025Regular price $849.99

-

Pre OrderJones Aviator 2.0 Men's Snowboard - 2025150 157W 159W 162 154 +1 More150 157W 159W 162 154 +1 MoreJones Aviator 2.0 Men's Snowboard - 2025Regular price $999.99

Pre OrderJones Aviator 2.0 Men's Snowboard - 2025150 157W 159W 162 154 +1 More150 157W 159W 162 154 +1 MoreJones Aviator 2.0 Men's Snowboard - 2025Regular price $999.99 -

Yes. Hel Yes Women's Snowboard - 2025Regular price $969.99

-

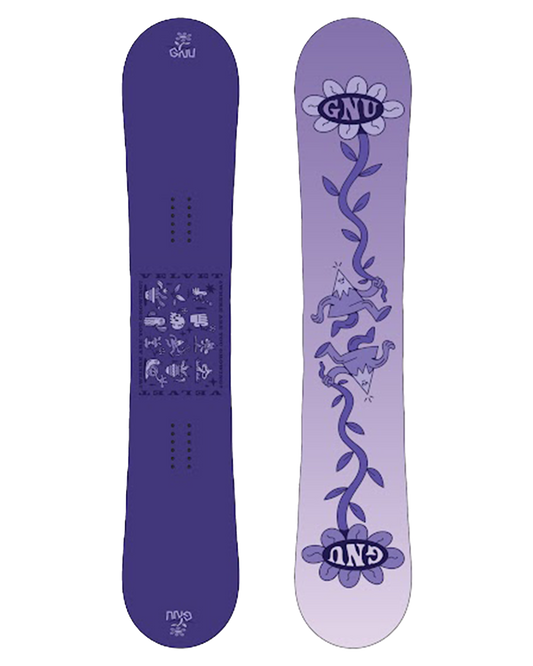

Gnu Velvet Women's Snowboard - 2025Regular price $899.99

-

Salomon Huck Knife Grom Kids' Snowboard - 2025Regular price $549.99

-

Pre OrderCapita Kazu Kokubo Pro Snowboard - 2025154 157 158W 161W 151 +1 More154 157 158W 161W 151 +1 MoreCapita Kazu Kokubo Pro Snowboard - 2025Regular price $1,199.99

Pre OrderCapita Kazu Kokubo Pro Snowboard - 2025154 157 158W 161W 151 +1 More154 157 158W 161W 151 +1 MoreCapita Kazu Kokubo Pro Snowboard - 2025Regular price $1,199.99 -

Salomon Hps - Wolle Nyvelt Fish Snowboard - 2025Regular price $949.99

-

Nitro Dinghy Snowboard - 2025Regular price $899

-

Salomon Assassin Pro Snowboard - 2025Regular price $989.99

-

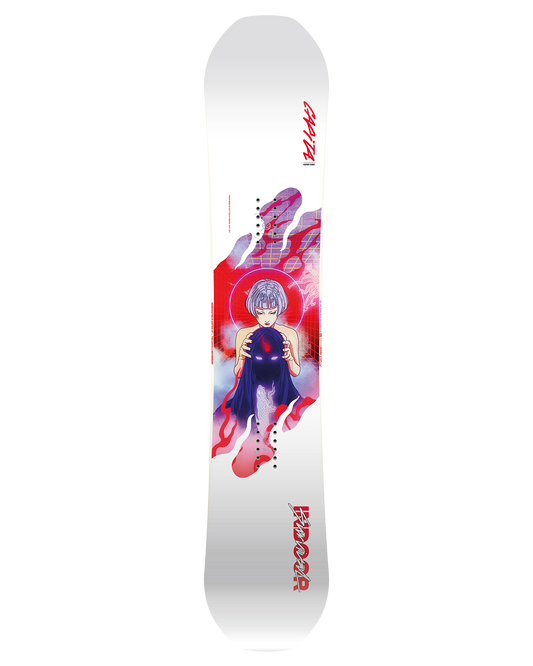

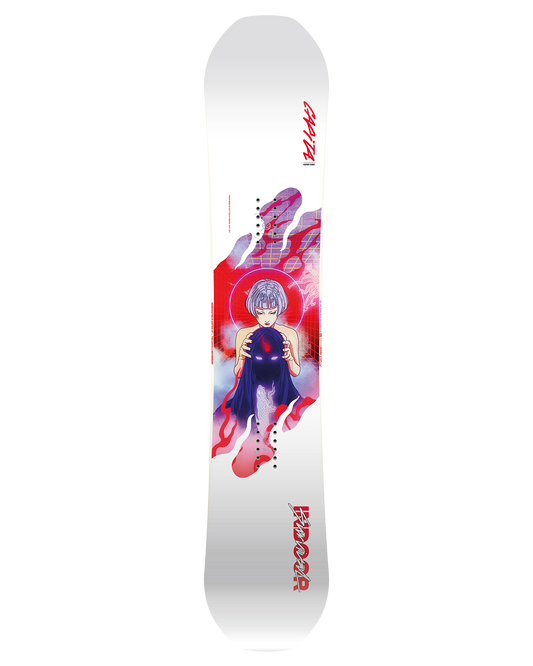

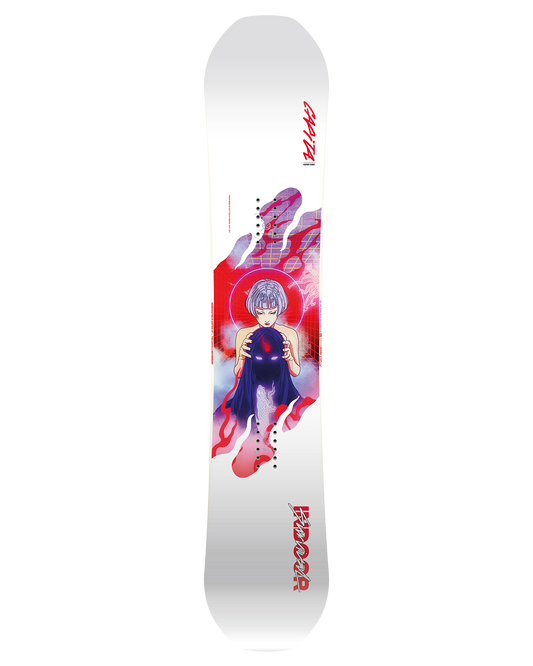

Pre OrderCapita Indoor Survival Snowboard - 2025150 152 154 156 158W +1 More150 152 154 156 158W +1 MoreCapita Indoor Survival Snowboard - 2025Regular price $1,049.99

Pre OrderCapita Indoor Survival Snowboard - 2025150 152 154 156 158W +1 More150 152 154 156 158W +1 MoreCapita Indoor Survival Snowboard - 2025Regular price $1,049.99 -

Pre OrderCapita Birds Of A Feather Snowboard - 2025142 144 146 148 150 +1 More142 144 146 148 150 +1 More+2Capita Birds Of A Feather Snowboard - 2025Regular price $949.99

Pre OrderCapita Birds Of A Feather Snowboard - 2025142 144 146 148 150 +1 More142 144 146 148 150 +1 More+2Capita Birds Of A Feather Snowboard - 2025Regular price $949.99

2025 Ski Pre-Orders

-

Salomon Qst Lumen 98 Women's Snow Skis - 2025Regular price $1,199.99

-

Volkl Mantra 88 Flat - 2025Regular price $1,349

-

Salomon Addikt Pro Snow Skis W/ Mi12 Bindings - 2025Regular price $1,499.99

-

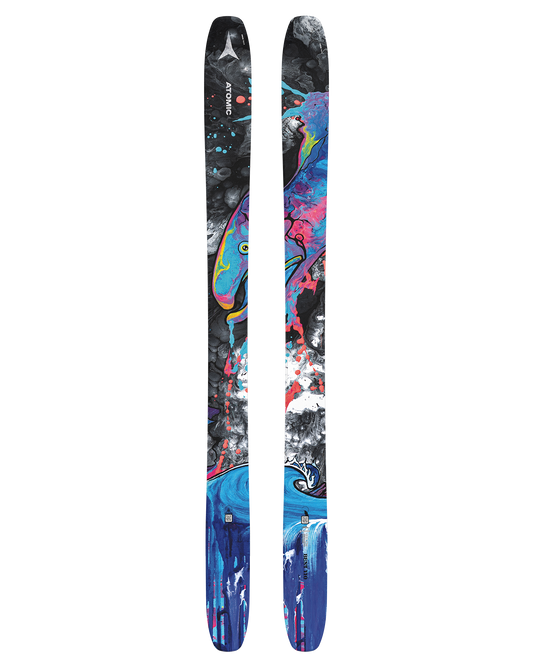

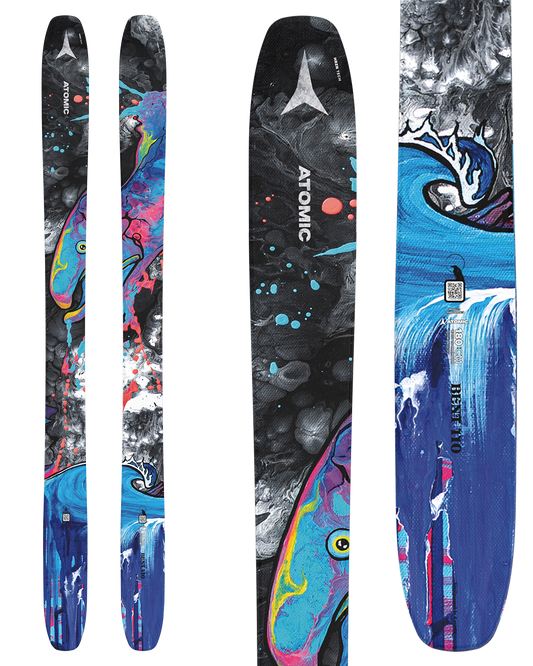

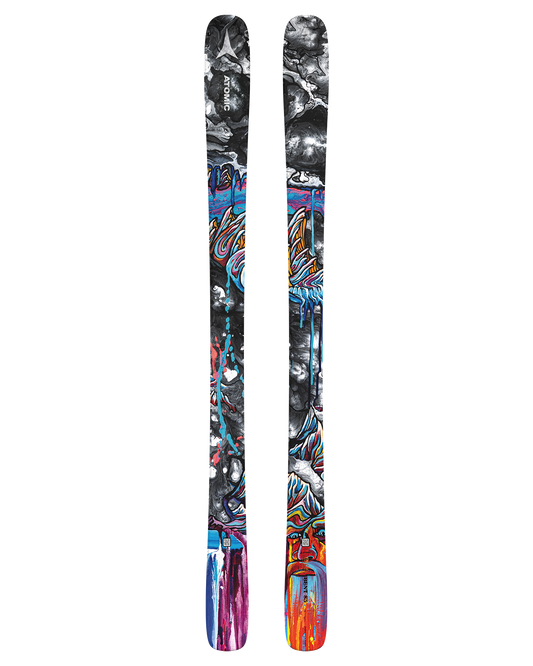

Atomic Bent 110 Skis - 2025Regular price $1,299.99

-

Atomic Bent 85 Skis - 2025Regular price $749.99

-

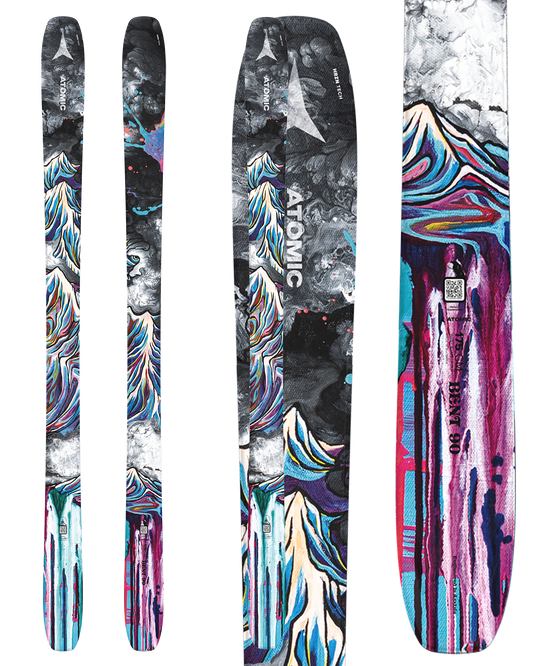

Atomic Bent 90 Skis - 2025Regular price $1,099.99

-

Atomic Bent 100 Skis - 2025Regular price $1,199.99

-

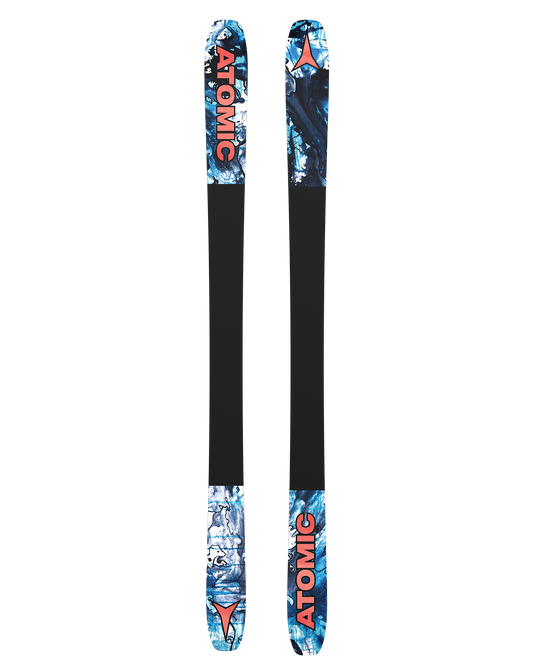

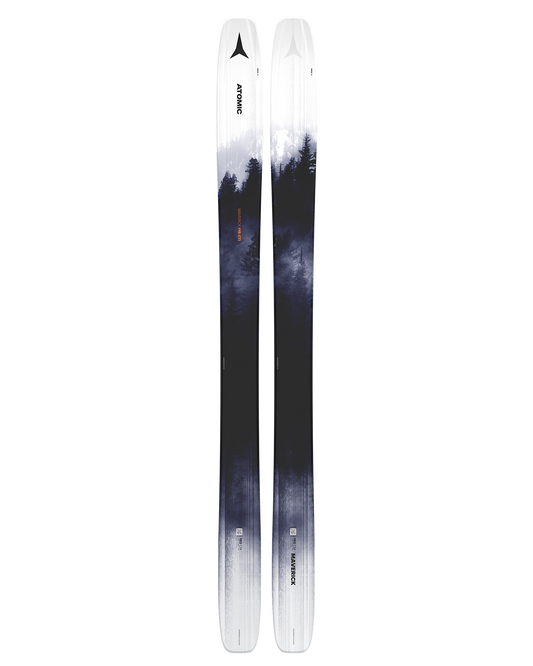

Atomic Maverick 115 Cti Snow Skis - White/Black - 2025Regular price $1,499.99

-

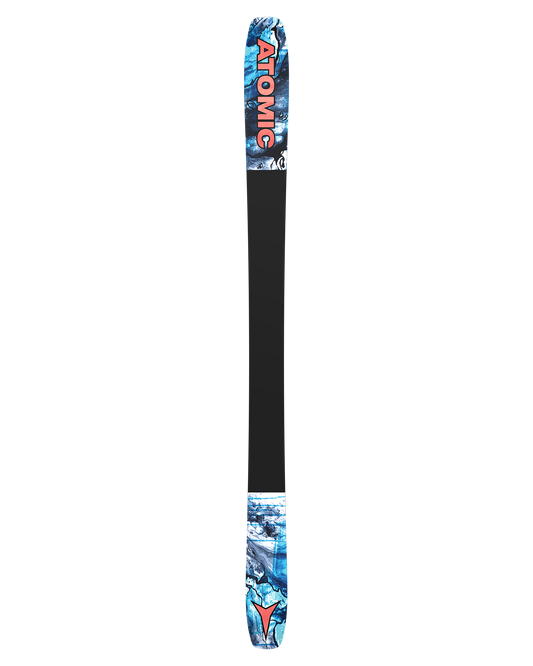

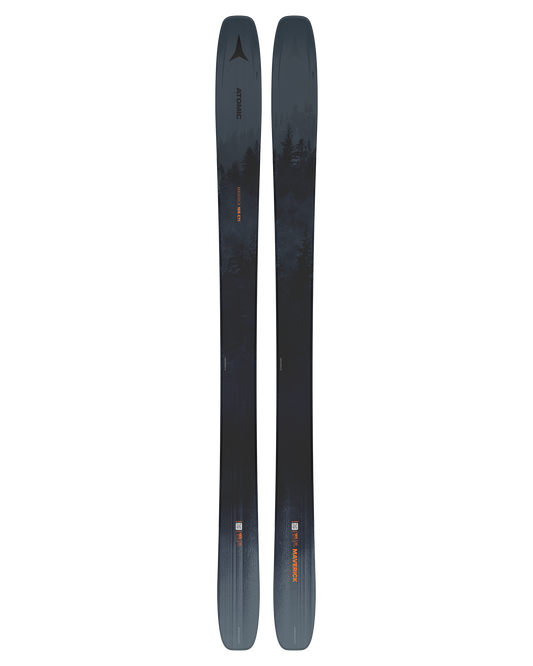

Atomic Maverick 105 Cti Snow Skis - Darkgrey/Black - 2025Regular price $1,399.99

-

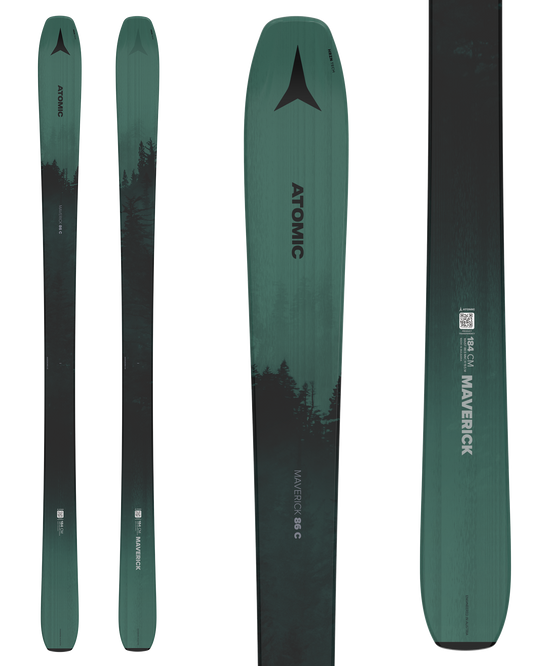

Atomic Maverick 86 C Women's Snow Skis - Dark Green/Black - 2025Regular price $949.99

-

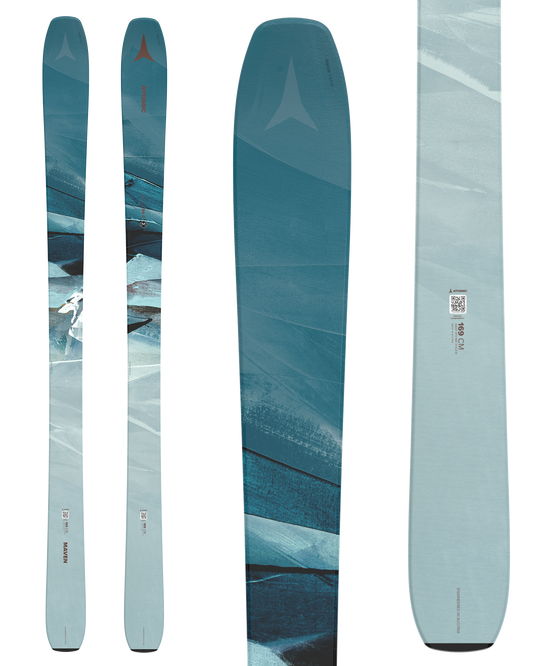

Atomic Maven 86 C Women's Snow Skis - Blue - 2025Regular price $949.99

-

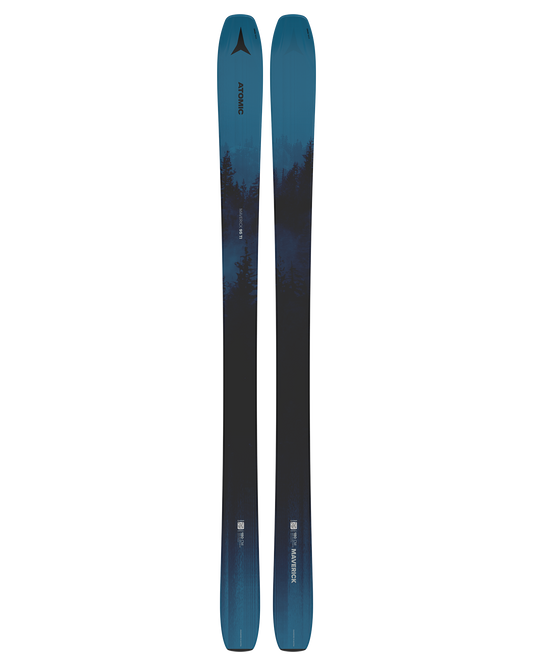

Atomic Maverick 95 Ti Snow Skis - Blue/Black - 2025Regular price $1,299.99

-

Atomic Maverick 88 Ti Snow Skis - Silver/Black - 2025Regular price $1,199.99

-

Volkl Revolt 90 Flat Snow Skis - 2025Regular price $1,099

-

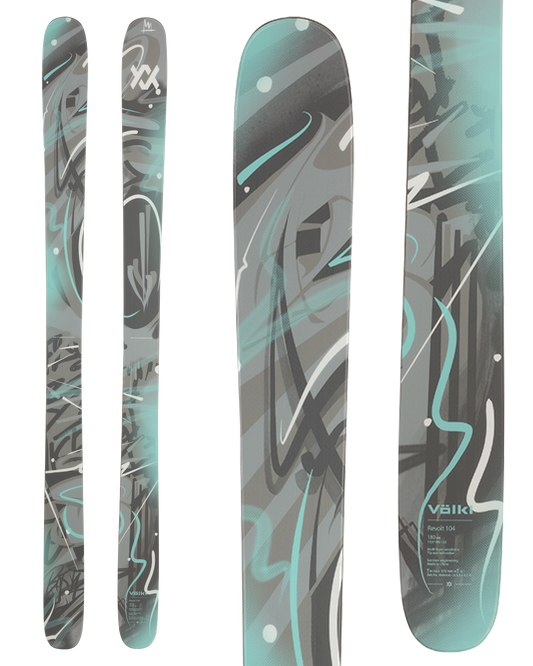

Volkl Revolt 104 Flat Snow Skis - 2025Regular price $1,099

-

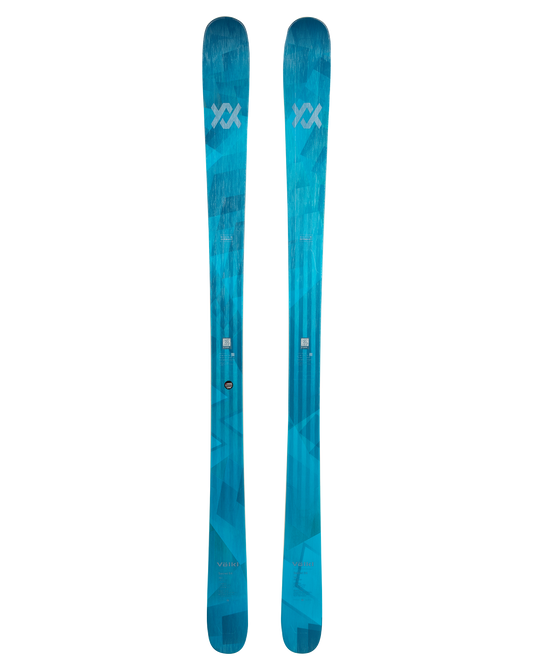

Volkl Secret 84 Flat Snow Skis - 2025Rated 5.0 out of 51 Review Based on 1 reviewRegular price $1,199

-

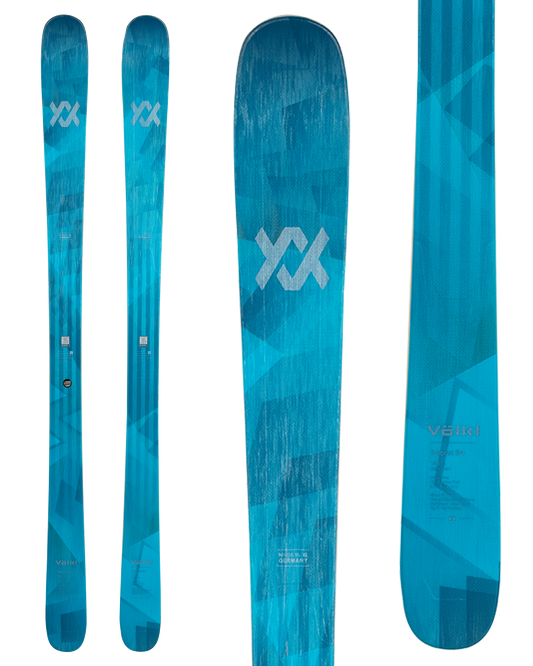

Volkl Secret 96 Flat Snow Skis - 2025Regular price $1,499

-

Volkl M7 Mantra Flat Snow Skis - 2025Regular price $1,499

-

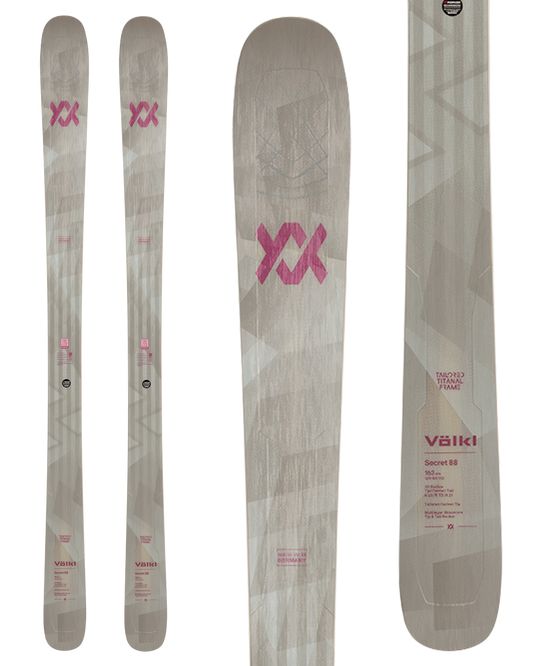

Volkl Secret 88 Flat Snow Skis - 2025Regular price $1,349

Featured Blog

-

Snowboard, Ski & Snow Gear HireWe have got you covered. Even if you only ski or board once a year it doesn’t mean you can’t have the best gear! Have a Question about rentals? Call us! Phone: (02) 9597-3422 Book Online Here If you are looking to hire for longer than our specified dates please call our friendly staff and w...Read More Snowboard, Ski & Snow Gear Hire

Snowboard, Ski & Snow Gear HireWe have got you covered. Even if you only ski or board once a year it doesn’t mean you can’t have the best gear! Have a Question about rentals? Call us! Phone: (02) 9597-3422 Book Online Here If you are looking to hire for longer than our specified dates please call our friendly staff and w...Read More Snowboard, Ski & Snow Gear Hire -

Ski Buying Guide - Snow Skiers WarehouseBuying new skis can be daunting, which is why we are here to help. When buying new skis there are no hard and fast rules for every person as ability level, skiing style and ski terrain can all influence the size and shape of ski that works best for you, in this guide we will explain how to find t...Read More Ski Buying Guide - Snow Skiers Warehouse

Ski Buying Guide - Snow Skiers WarehouseBuying new skis can be daunting, which is why we are here to help. When buying new skis there are no hard and fast rules for every person as ability level, skiing style and ski terrain can all influence the size and shape of ski that works best for you, in this guide we will explain how to find t...Read More Ski Buying Guide - Snow Skiers Warehouse